ㅤPayroll accounting is the most common situation when setting up management accounting. At Finmap, we have tried to simplify this moment as much as possible. Just specify to whom the salary is paid, when you pay it, and for what period.

ㅤ

ㅤ

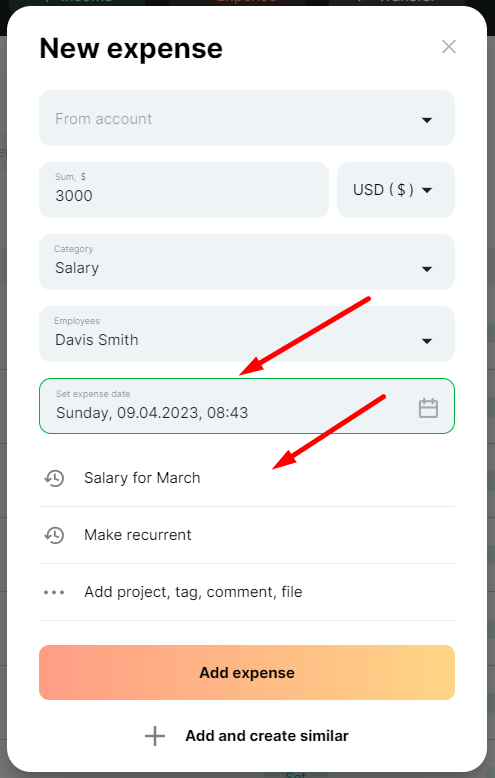

Create an expense with the Salary category type, fill in the field with the amount. In the “Counterparty” field, specify the data of our employee – Full name or just a name, indicate the date when the salary is paid, and select the period for which the funds are paid

ㅤ

ㅤ

ㅤIf you pay bonuses or bonuses in addition to the rate, you can make this a separate expense, for example, at the end of the month after calculating the plan’s fulfillment;

ㅤIf you have several departments and many employees, you can specify the name of the department head and calculate the total salary in one operation.

ㅤ

ㅤ

ㅤㅤ

ㅤ

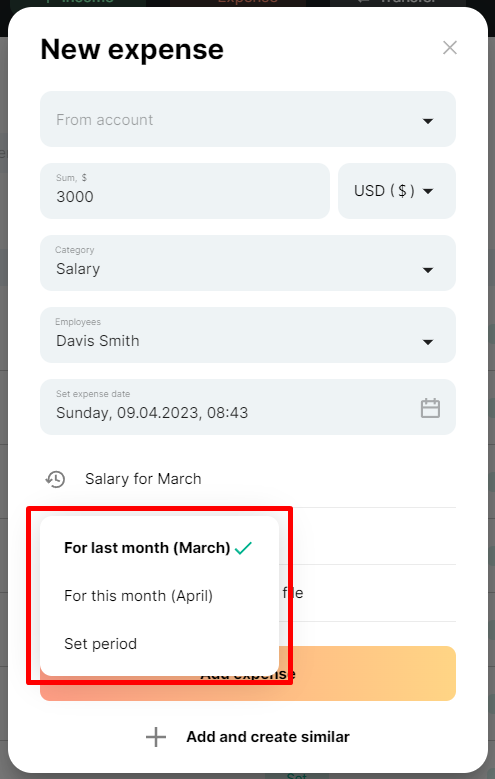

ㅤThe Salary system category allows you to select the required payment period. It can be specific dates, current or previous month

ㅤThe service also allows you to make this operation recurring, where you can specify the frequency with which the salary will be paid

ㅤ

ㅤ

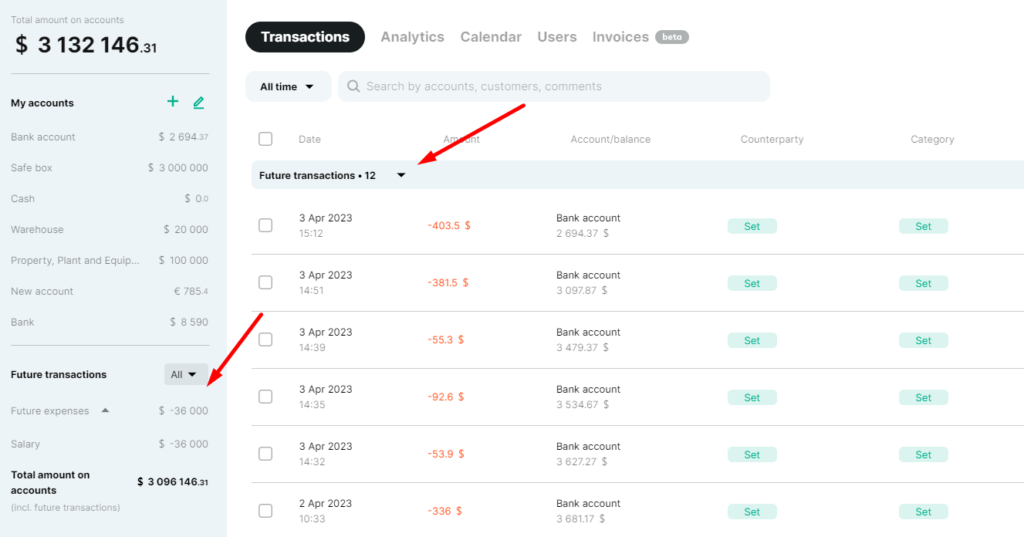

ㅤLet’s look at the scenario where we have scheduled an employee’s salary payment for a year in advance.

ㅤ

ㅤ

ㅤIn the panel on the left, we can immediately see the total amount of expenses for the Salary category for the entire period. As well as future scheduled payments

ㅤ

ㅤ

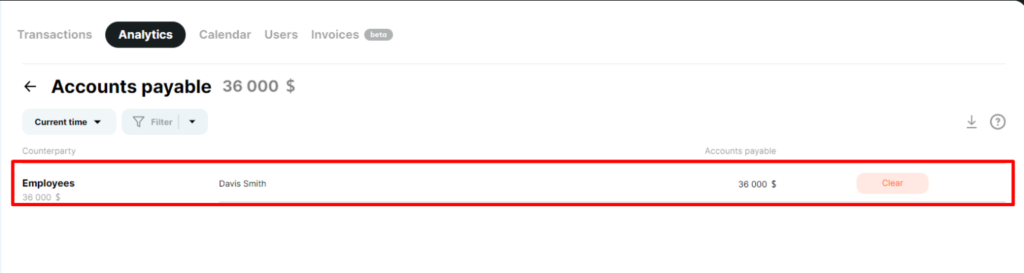

ㅤLet’s take a look at what information we see in the Analytics reports. In the Accounts payable report, you can see the total amount owed to your employee

ㅤ

ㅤ

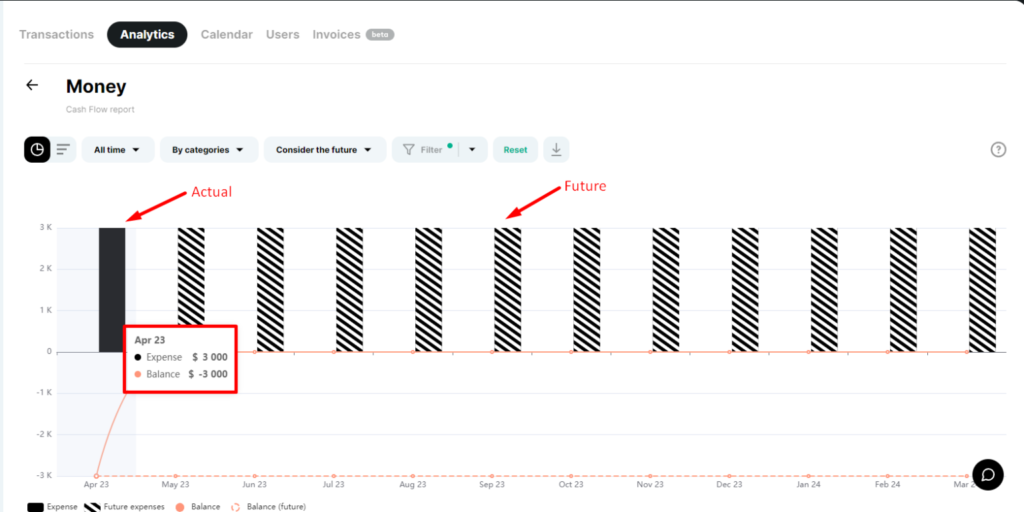

ㅤ In the Money report, we can see the actual payment of salaries in December, exactly when we made this payment, as well as the planned future payments

ㅤ

ㅤ

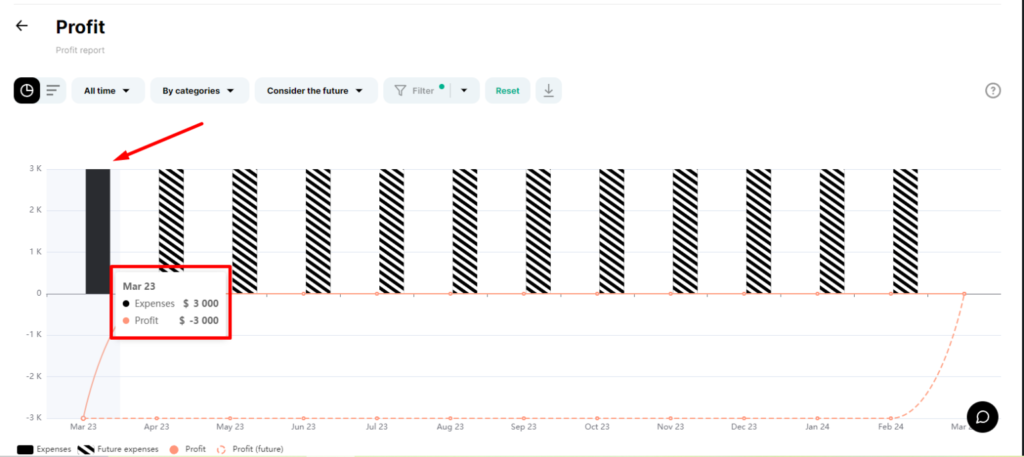

ㅤIn the Profit report, this salary payment should be recorded for November. This is what we see in the selected report;

ㅤ

ㅤSo, in the Money report, we see the date when the funds were actually written off in the Salary category, and in the Profit report, the accrual period